SoFi Technologies Shares Plummet 13% After Announcement of Stock Offering

Subprime Lender Plans to Raise $1.25 Billion in Capital

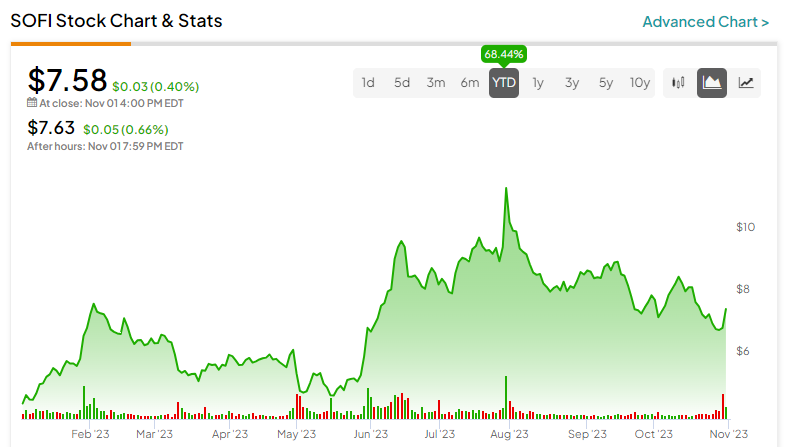

Shares of SoFi Technologies (SOFI) fell sharply on Tuesday after the company announced plans to raise $1.25 billion through a stock offering.

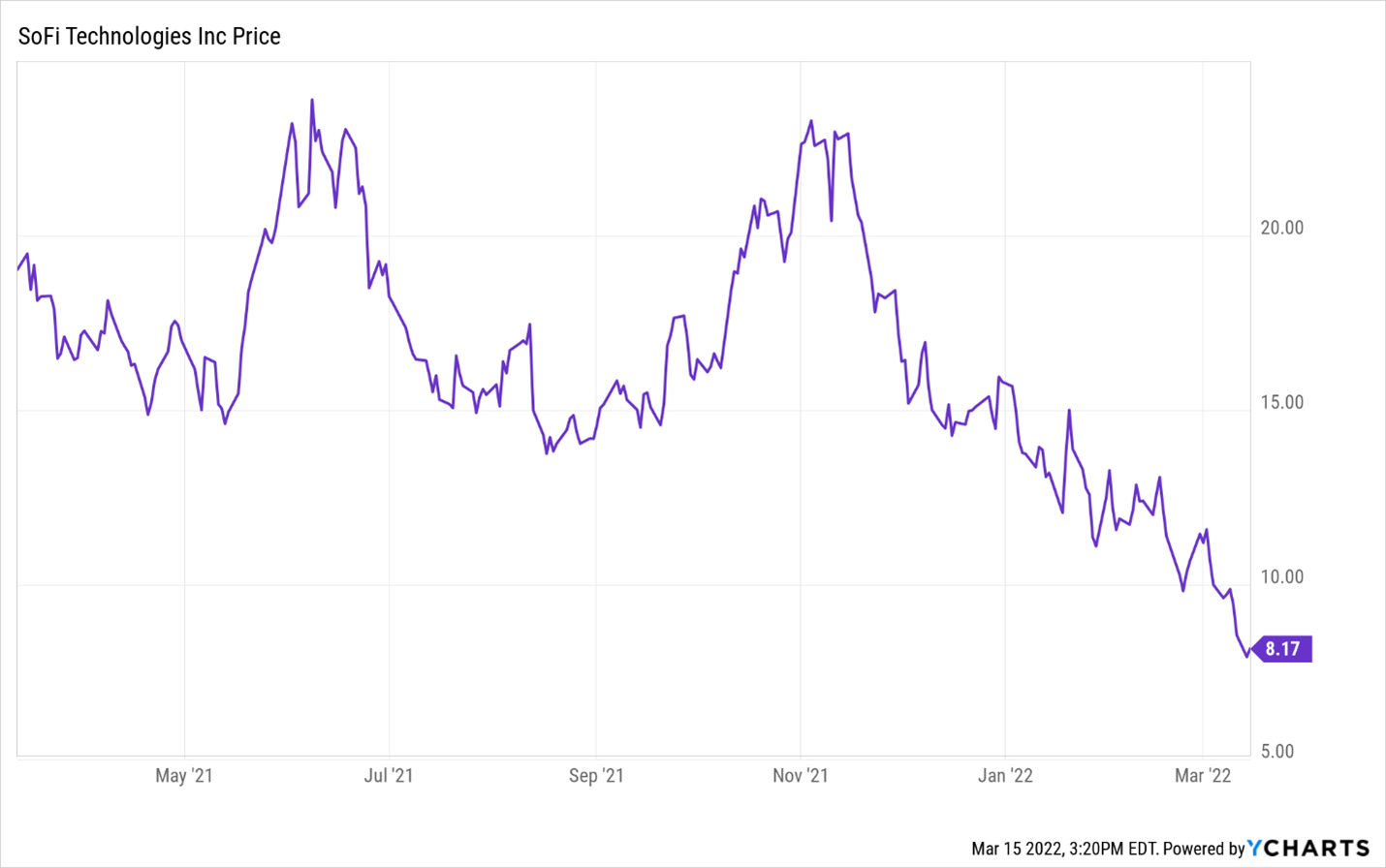

The news sent shares of SOFI tumbling 13%, closing at $7.59. The stock has now lost more than half of its value since reaching a high of $17.70 in March 2021.

SoFi said it will use the proceeds from the stock offering to fund its growth initiatives, including expanding its lending业务 and investing in new products and services.

The company has been under pressure to raise capital as it faces increasing competition from traditional banks and other fintech companies.

SoFi's stock offering is the latest sign of the challenges facing the fintech industry. Many fintech companies have seen their stocks decline sharply in recent months as investors have become more cautious about the sector.

Comments